Fundamental Insights

#1 ZK Hardware

In the last week, we released a research paper about opportunities in zero-knowledge industry. Customized chips for ZK mining would be a huge opportunity. This week, Paradigm released a blog about hardware acceleration for zero-knowledge proofs. Let's continue the discussion on ZK chips.

We are optimistic about ZK chips because we believe most transactions that happened on Ethereum will happen on layer2. More users and transactions on layer2 mean more value on layer2. Layer2 miners will be greatly incentivized. They will compete with each other and try to get the transaction package right. The key to winning this competition is computation power. Miners need a more efficient way to calculate the ZK proof.

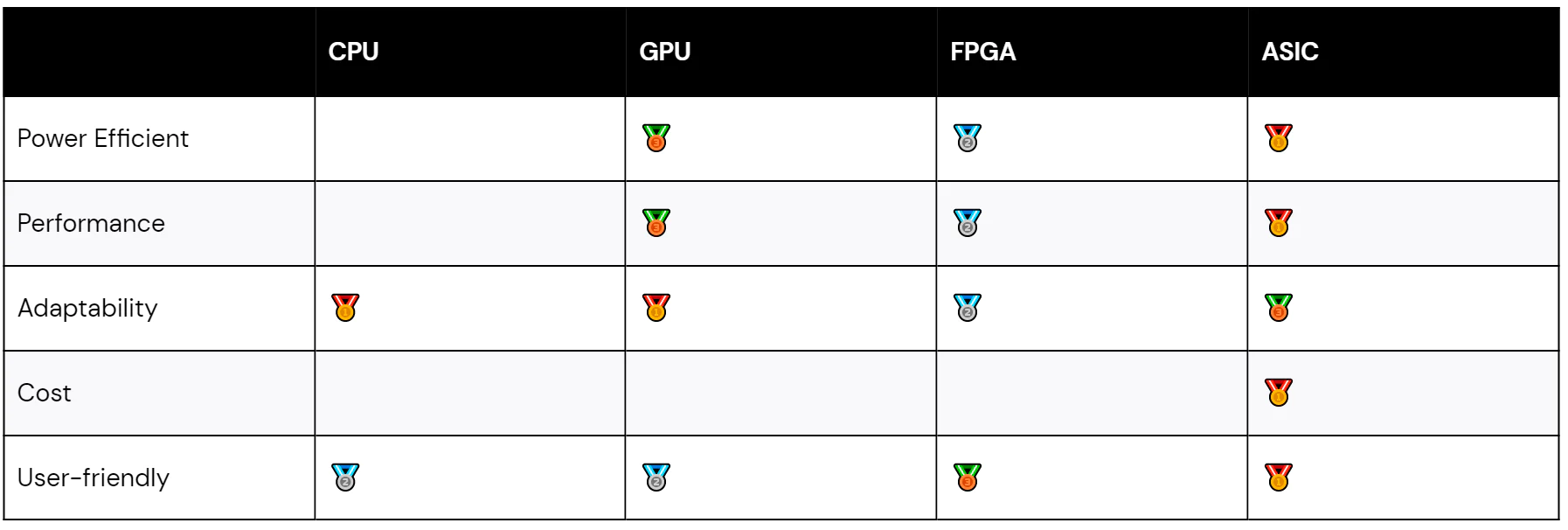

Following what happened in the Ethereum mining industry, miners will first use the most accessible hardware, CPU, and GPU to generate ZK proof. This requires developers to do some optimizations for CPU and GPU. Then FPGA will appear on the market. It will be 1-2 years later than CPU and GPU because the design and produce FPGA need time. FPGA is Field Programmable Gate Arrays. It contains lots of configurable logic blocks. FPGA can be reprogrammed for different tasks. After FPGA, we will see ASIC. ASIC is application-specific integrated circuit. ASIC can be customized for the particular usage, but it costs a lot to produce. ASIC has the best performance and lowest power consumption. After massive production, the high cost of production ASIC will not be a problem. The biggest problem of ASIC is that it can only be used for specific tasks. If the task changes, the ASIC can no longer be used. Nowadays, ASIC miners are popular in bitcoin mining because the performance and the bitcoin consensus do not change. However, in ZK mining, there are new ZK prove systems every year. The layer2 may switch between different ZK proof systems for better performance and features. However if layer2 switches to new ZK proof systems, layer2 needs to rework zkEVM. ASIC or FPGA in the future? It is based on the layer2 strategies for ZK proof systems.

The same way that AI ASICs exist on every iPhone today, SNARK ASICs will be on every iPhone in 10 years.#2 How to better understand how DAOs work? Three interesting analogy perspectives

We can compare them with existing organizational structures. Although fundamentally different, we can take a step closer to understanding DAOs by thinking of them as companies, cooperatives, and networks.

1 Companies are still a useful framework for understanding DAOs.

Larger DAOs often operate in a company-like fashion, with well-defined "departments" such as product, marketing, engineering, and community. Each department usually has a team leader who directs and supports the work of other members, similar to a manager.

DAO leadership tends to be fluid and non-hierarchical, akin to a "Teal organization." Management researcher Frederic Laloux defines a Teal organization as autonomous and spontaneous. They also encourage employees to devote their full energy to the organization.

2 DAO as a cooperative

From an "ownership" perspective, a DAO is very different from a corporation, and a cooperative might be a more apt analogy.

Cooperatives are owned and controlled by workers who contribute to them, similar to DAOs. In a DAO, stakeholders receive tokens that grant governance and distribute ownership, much like co-op workers get paid for grocery shopping. The difference is that DAOs are not limited by physical distance.

3 DAO as a network

The DAO assigns ownership not only to the organization's contributors (which are equivalent to employees in a certain dimension and are members of the organization), but other such as users (if the DAO is building a product), strategic partners, suppliers, and mission-aligned community members A series of stakeholders, etc., may be assigned to the ownership of the DAO.

This distribution model also makes a difference between DAOs and pure cooperatives, DAOs become more network-like, members can interact freely, and their roles are changing frequently and naturally and smoothly.

In many dimensions, the "network" is the most useful framework for understanding DAOs.

The "web" is not a new concept, but it is especially applicable in the Web 3.0 era. Networks are an effective form of organization when the scope of coordination is large, both in the public sector and in the private sector. As DAOs grow in size and complexity, the network model allows organizational reconciliation to move forward in a scalable manner.

Does the above framework make sense two years from now? What about in five years?

Even today, there may be a dozen or more ways to understand and perceive DAOs, and given the rapid innovation in the field, we may see DAOs very differently in a few years time. But in the long run, the basic goal of DAO shared value creation will likely remain unchanged.

#3 Omni-chain NFTs on LayerZero

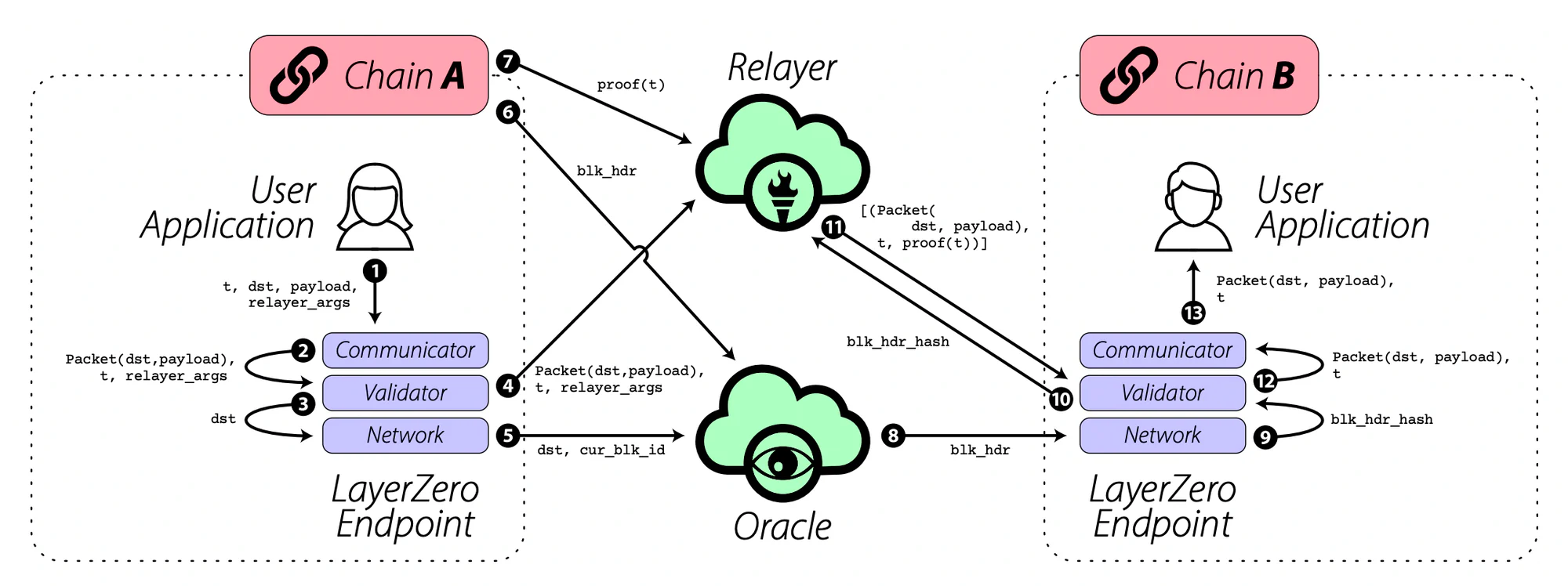

LayerZero is a cross-chain protocol that allows applications deployed on different chains to communicate with each other. LayerZero does not require an intermediate node or consensus mechanism like a cross-chain bridge but allows applications to seamlessly communicate across chains. The first DEX on LayerZero is Stargate Finance, a project that allows Omni-chain assets to swap across chains.

Source: LayerZero Whitepaper

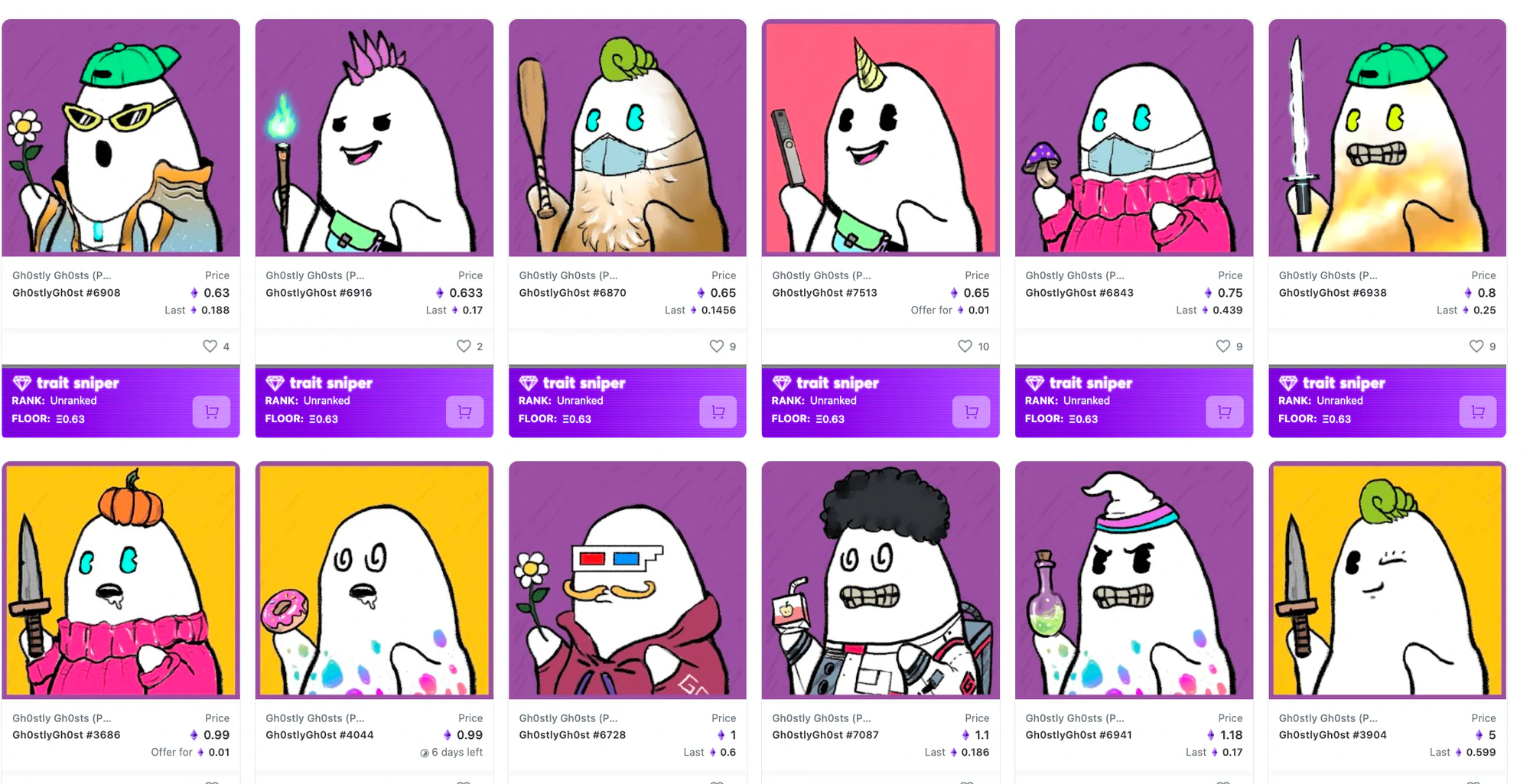

Recently a lot of Omni-chain NFTs have appeared in the market. But Omni-chain NFT maybe not be suitable for PFP. The reason why this NFT has not reached a kind of cross-chain for PFP is really that it is more suitable to stick to that chain of its own.

The most popular Omni-chain NFT on LayerZero now is Gh0stly Gh0sts. When an NFT transfer, will first burn the NFT on this chain and then in another chain mint a new one out, then it seems to be changed to burn compared to the traditional cross-chain bridge locking action.

One problem is the price threshold. ETH gas cost is relatively high, so it has filtered out part of the consumer base. For example, the amount of money and the pace of users rushing meme coins on BSC and on ETH are not the same. The second point maybe because of the NFT community. For PFP, the atmosphere and community building of the community occupy a large part. Of course, in addition to these, whether the code is NATIVE is also important. Each chain has a corresponding community, people who love the ETH chain may not go to SOL or BSC for NFTs, and their community may be more sticky. But if land-based projects, such as Gamefi or Metaverse, then I think they may need more cross-chain.

Source: Opensea

Week's Recap

- Uniswap Labs Ventures

- Improbable raises $150 million to build an interoperable 'metaverse' network

- CertiK reaches $2 billion valuation with new funding from Goldman Sachs and others

- HBAR Foundation launches a $250M metaverse fund to enhance consumer brand adoption

- Porter Finance Raises $5M to Bring Credit to DAOs

- Announcing Investin’s $1.2M Funding Round

- White Star Capital Raises $120M Crypto Fund for Metaverse Investments

- Volt Protocol Raises $2 Million for 'Inflation-Resistant Stablecoin’

- Pantera to close Blockchain Fund soon after raising $1.3B — double the target

- SoftBank leads $70 million round for DeFi infrastructure firm BloXroute

- Web3 'follow' app Context announces $19.5 million seed round

- Ethereum Push Notification Service raises $10 million in Series A funding

- Avalanche developer raising $350 million at $5.25 billion valuation: report

Indicator Tracking

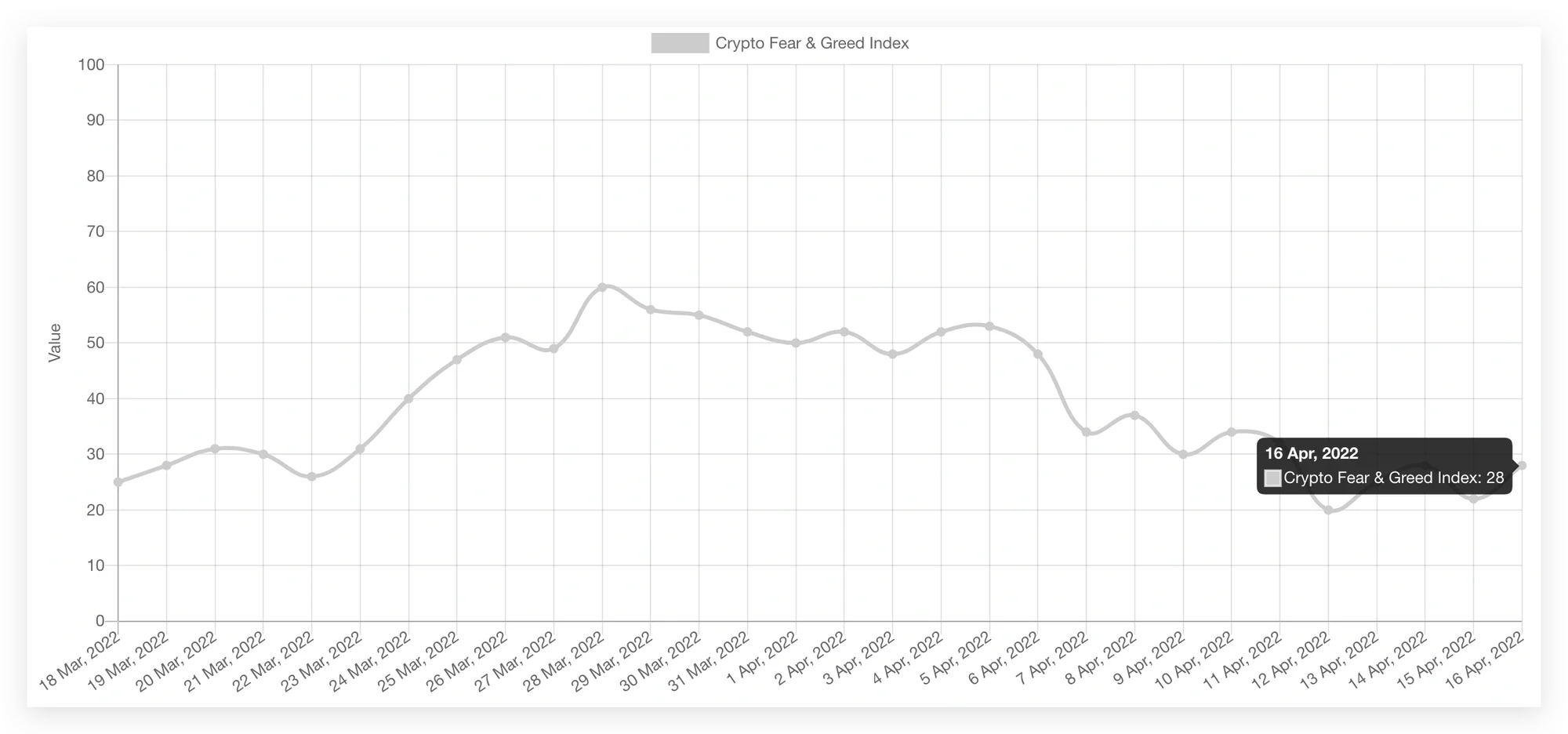

Crypto Fear & Greed Index

source: Alternative

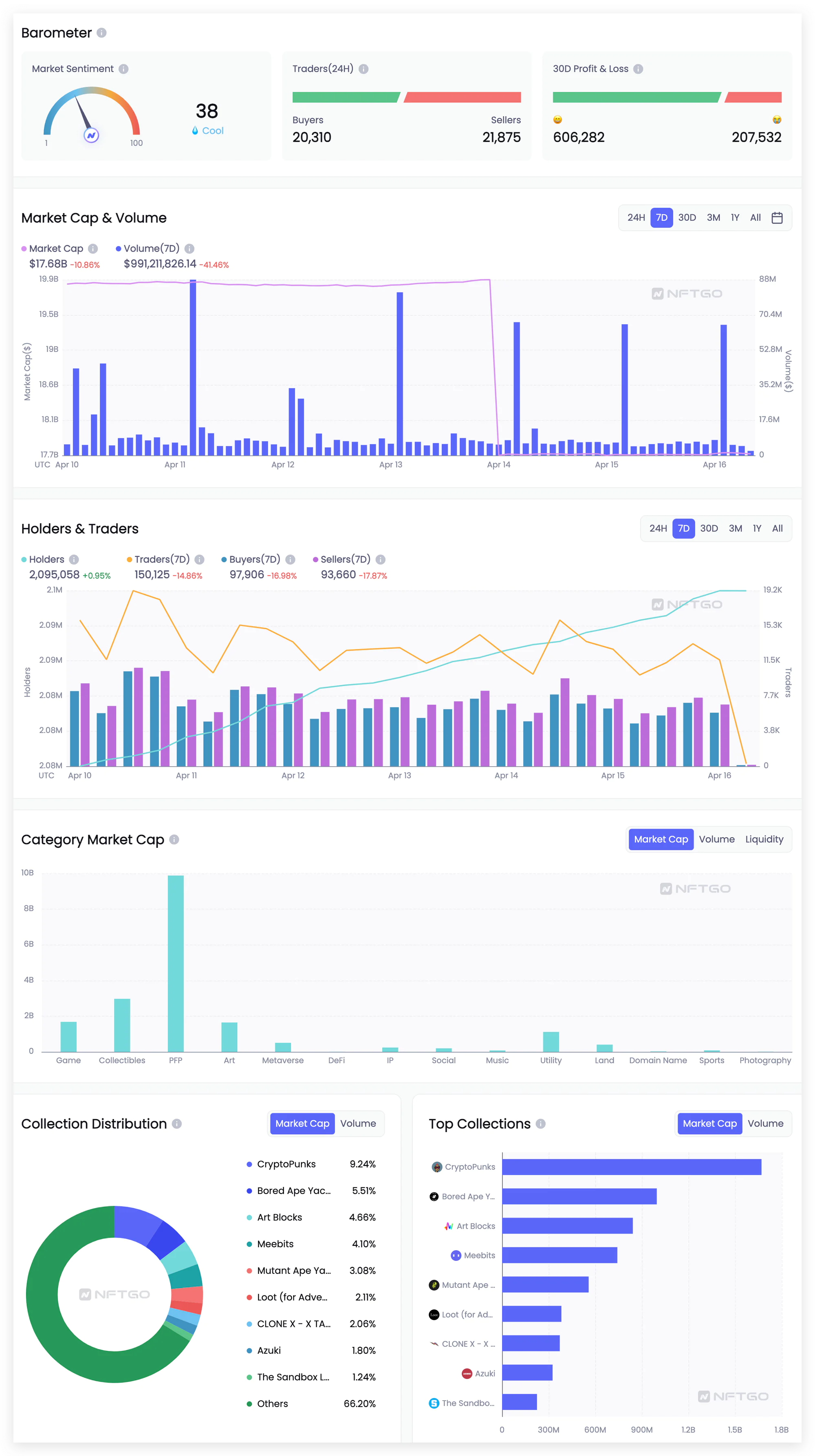

Data of NFT Market

source: NFTGo

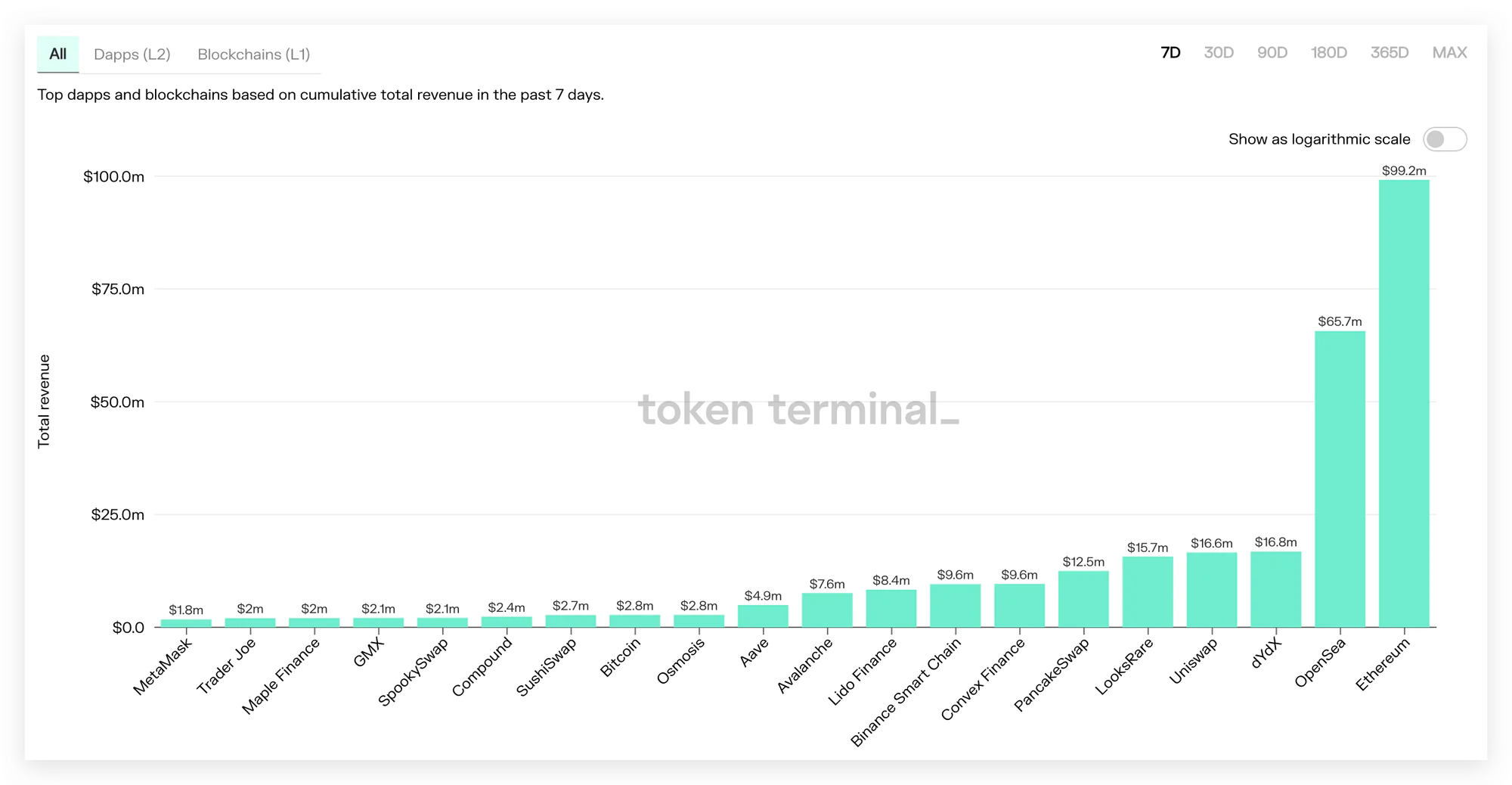

Protocol Total Revenue

source: Token Terminal