Fundamental Insights

#1 Growing Influence of Web3 Development Tools in Open Source Community

Web3 development libraries are become popular these days. More developers are interested in smart contract developments. Web3 development libraries are more and more influential in open source community. Several great web3 development libraires are nominated in Open Source Awards.

GitNation is the organization behind Open Source Awards. On their official website, they introduce themselves as "GitNation Foundation contributes to the development of the technological landscape by organizing events focusing on open source software. We run meaningful and entertaining conferences and meetups, connecting talented engineers, researchers, and core teams of important libraries and technologies".

🎉 Congratulation on the best web3 projects being nominated.

- Wagmi is nominated as React Breakthrough of the Year. Wagmi is a React library for developing the Web3 frontend. It provides lots of useful hooks for interacting with EVM-compatible chains and wallets.

- Web3 React is nominated as React The Most Exciting Use of Technology. Web3 React is one of the oldest react web3 libraries. It provides lots of useful hooks but is lack documents.

- Web.j3 is nominated as JS Breakthrough of the Year. Web3.js is a library to help browser users interact with wallet and Ethereum.

- Hardhat is nominated as JS Productivity Booster. Hardhat is a smart contract development framework that provides compilation, deployment, and test functions.

Hot Topics

#1 Cryptocurrency's Lehman moment

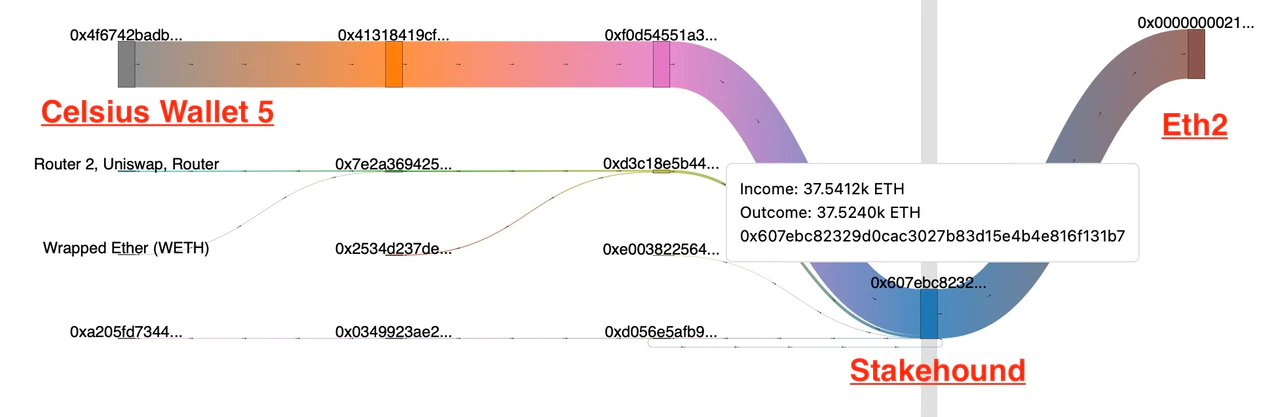

The collapse of the UST took a significant toll on many institutions in the crypto industry, but the market was not the first to react due to the opaque nature of CeFi institutions. The panic started with an article from Dirty Bubble Media, which stated that the centralized lending platform Celsius lost at least 35,000 Ether in the Stakehound key blunder, which triggered a run on Celsius' withdrawals, and Celsius had to sell stETH to cope with the crisis. Celsius had to sell stETH to cope with this crisis. But the selling of stETH caused its price to de-anchor from ETH, which triggered an even bigger panic.

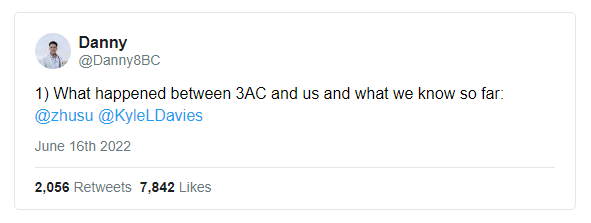

Since then, 3AC has been exposed as having suffered heavy losses in the UST event and holding large stETH and GBTC positions. Later, Danny from 8BlockCapital took to Twitter to reveal that 3AC had misappropriated user assets. Since then, 3AC's risk was completely exposed and the market was further panicked.

During this period, there were further outbreaks that BlockFi also had liquidity risk issues, while several lending platforms such as Babel issued announcements that their platforms were experiencing liquidity problems and suspending user withdrawals. The constant risky events sent the market into a huge panic, and cryptocurrency prices fell sharply.

Source: CoinGecko

Looking back at this series of crises, the core issue is the general lack of transparency of centralized lending platforms, which all have problems with concealing facts and misappropriating user assets. In contrast, DeFi has won in terms of transparency, and if there were problems, they would have been discovered at a relatively early stage, rather than in a similar black swan event.

Week's Recap

- Alchemy Launches $25M Developer Grant Program to Fund Web3 Projects

- Immutable launches $500 million development fund for web3 game adoption

- Foresight Ventures launches $200M private-round crypto-asset fund

- Announcing Endaoment's $6.67m Capital Fundraise

- Clockwork Raises $21M Series A Led by NEA

Indicator Tracking

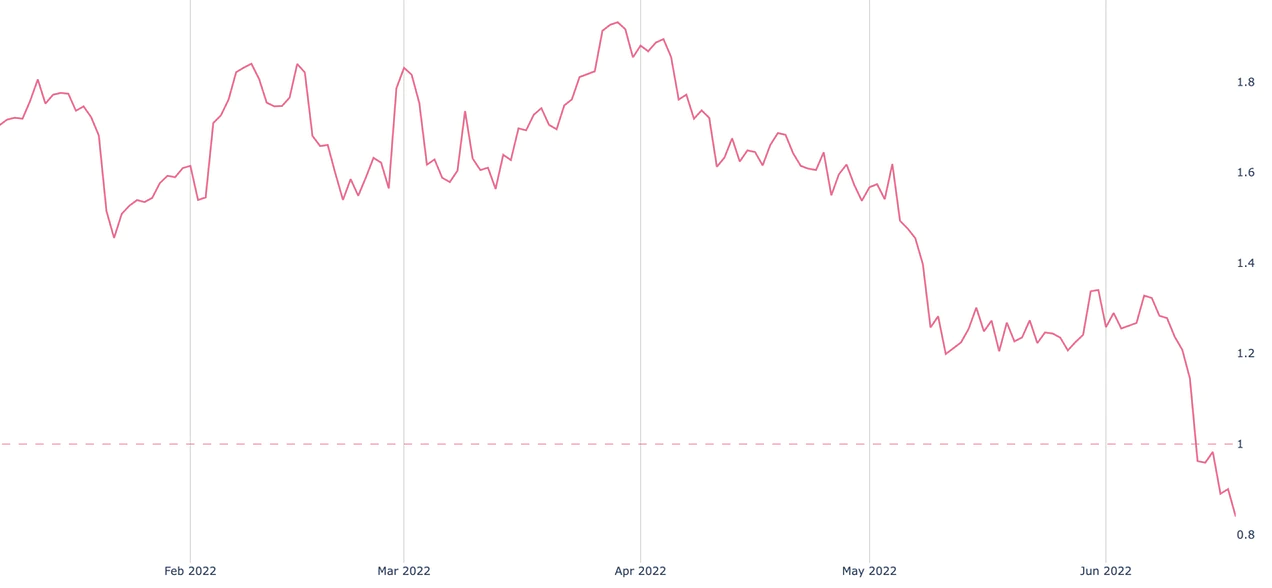

MVRV

source: Coin Metrics

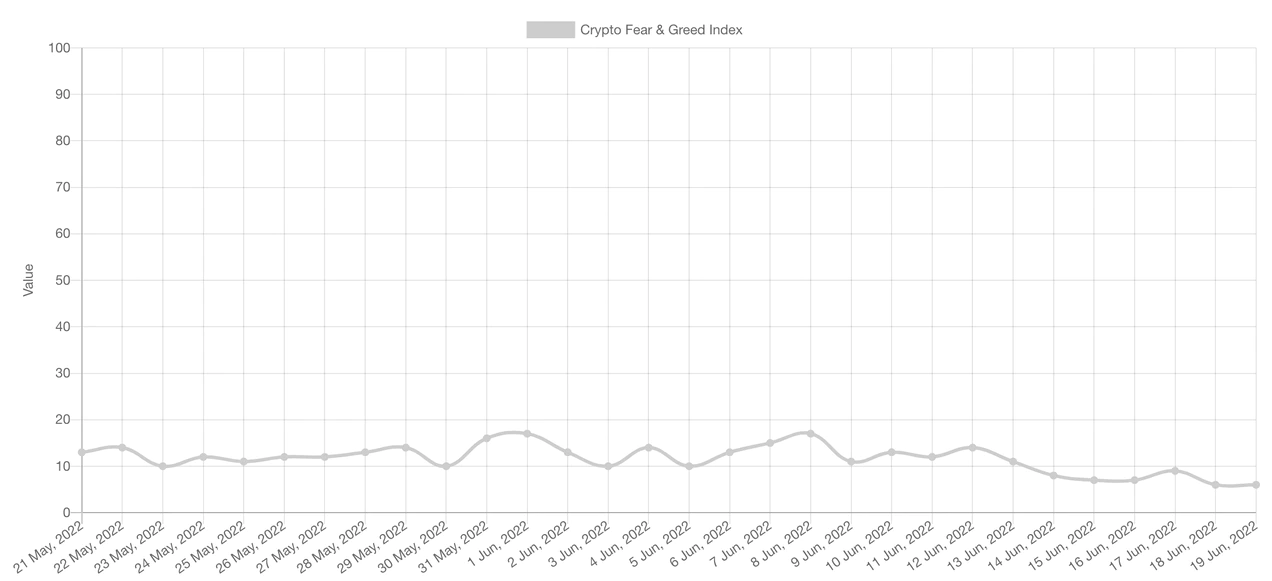

Crypto Fear & Greed Index

source: Alternative

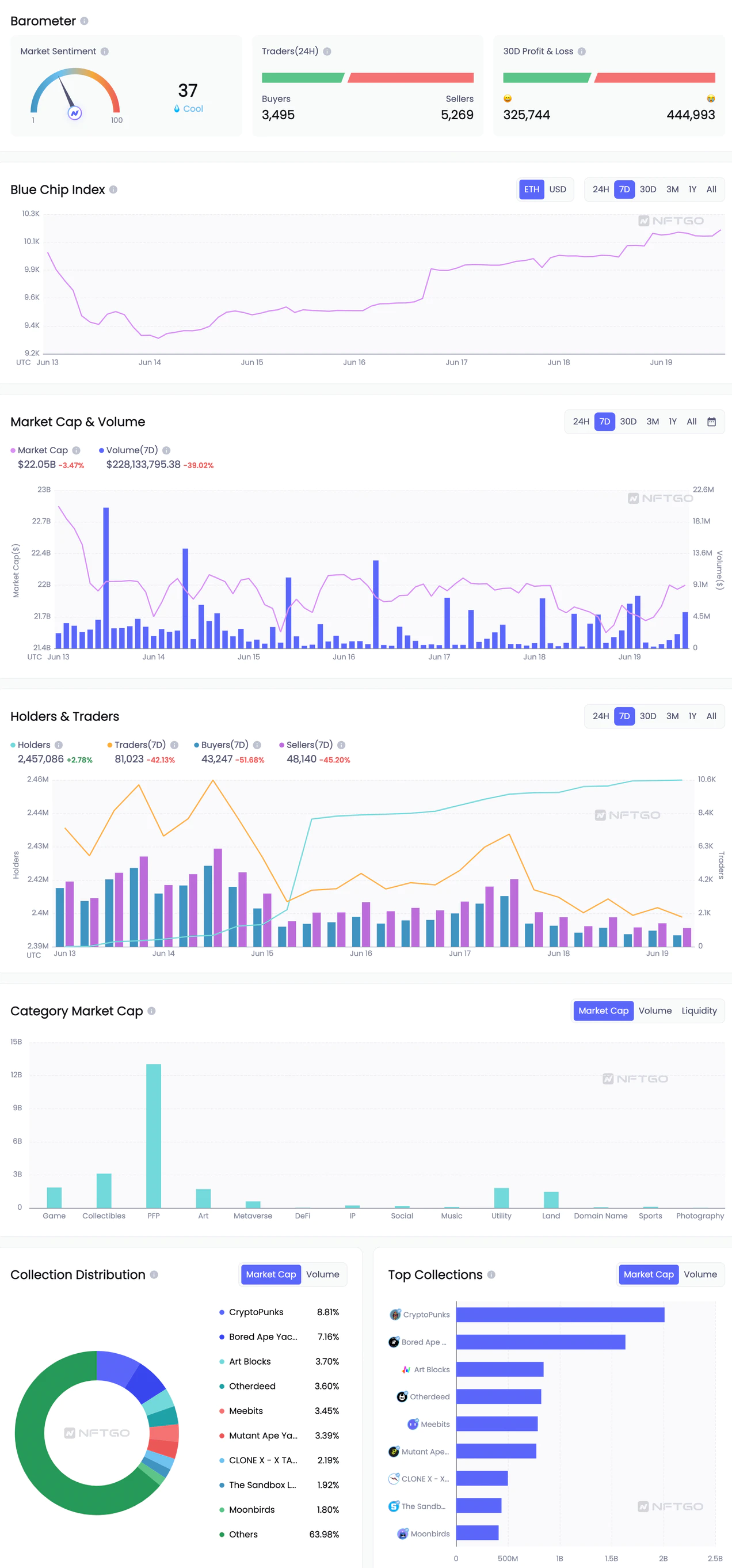

Data of NFT Market

source: NFTGo

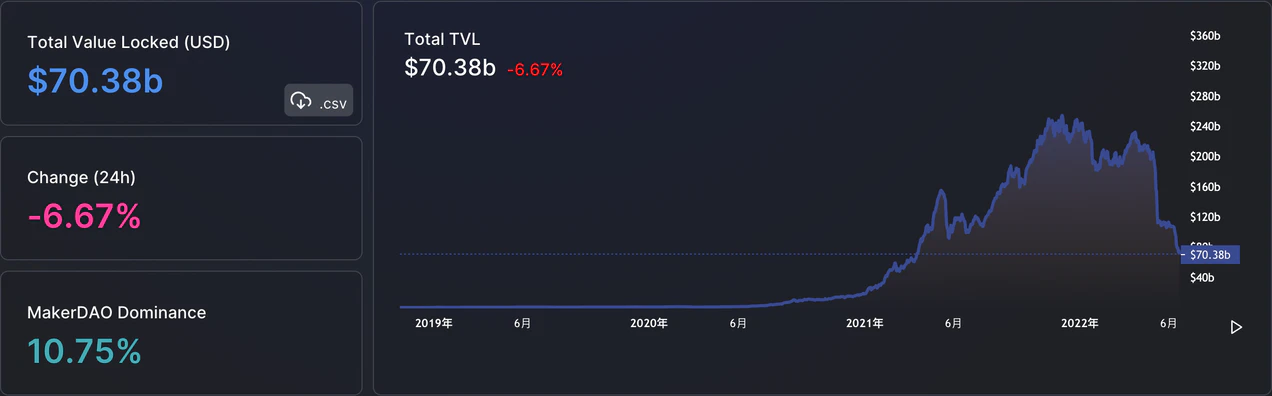

Total Value Locked of DeFi

source: DeFiLlama

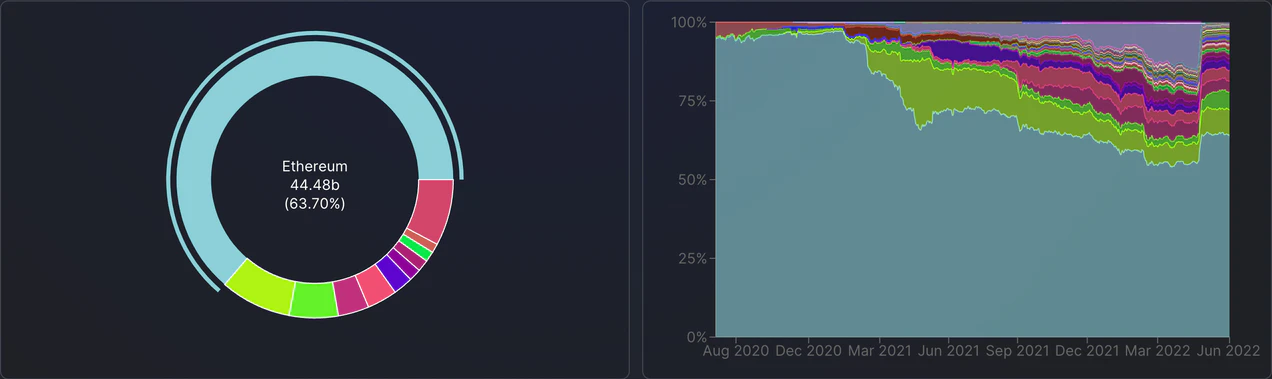

Total Value Locked All Chains

source: DeFiLlama

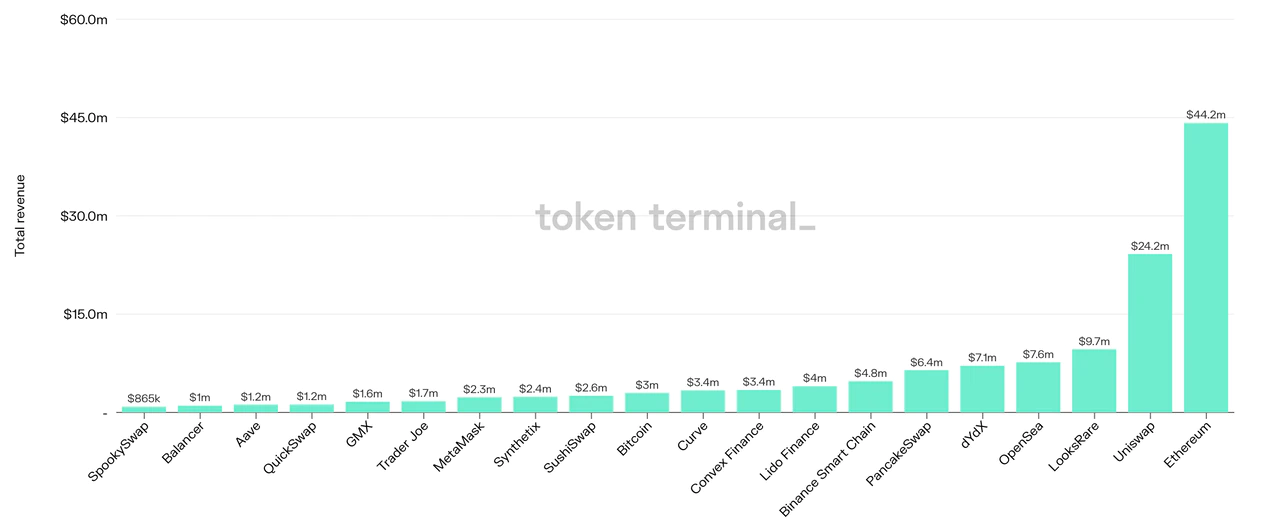

Protocol Total Revenue

source: Token Terminal