I. The encounter between BTC and DeFi

Decentralized Finance (DeFi), as the name implies, is decentralized finance. As the most popular sector in the digital asset market this year, DeFi has received great attention from the capital in the industry. According to the latest data from DeBank, the total DeFi lock-up volume (TVL) has exceeded 22 billion U.S. dollars, while the TVL at the beginning of the year was only 752 million U.S. dollars, a year-to-date increase of more than 2800%. At present, the DeFi market is still at a high-growth stage, and more innovative applications continue to appear.

Figure 1 DeFi market TVL growth, Source: DeBank

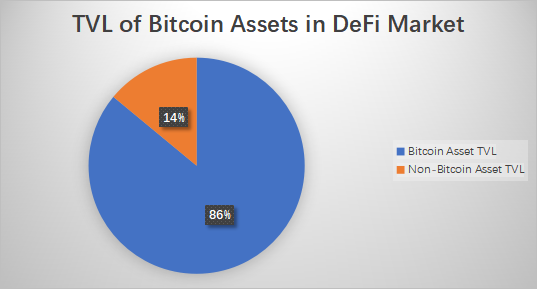

Although the DeFi market is growing rapidly, the capital volume carried by the DeFi ecosystem only accounts for 3% compared to the total market value of $740 billion in the digital asset market. The vast majority of DeFi projects are currently built on the Ethereum public chain, which itself has a market cap of only $28 billion. Bitcoin, the core asset that accounts for nearly 70% of the industry's total market cap, seems to have become the elephant in the DeFi room ("Elephant in the room").

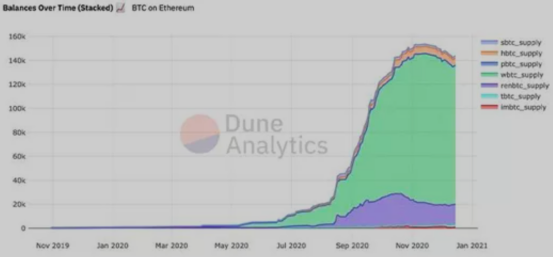

Native Bitcoin cannot directly participate in the DeFi ecosystem because the Bitcoin network is not compatible with the Ether network. However, bitcoin holders can exchange bitcoin assets in the form of ERC 20, such as wBTC, renBTC, sBTC, etc., on the Ethereum chain by pledging BTC on one side of the bitcoin blockchain at a 1:1 exchange rate through cross-chain lossless acceptances, thus enabling bitcoin holders to participate in the DeFi market. Since May of this year, the volume of bitcoin assets locked on the Ethereum chain has grown rapidly, with more than 150,000 bitcoins entering the DeFi market at one point.

Figure 2 TVL growth of bitcoin assets on the ethereum chain, Source: dune Analytics

As of December 25, 2020, the total amount of wBTC locked has reached 2.65 billion US dollars, accounting for 80% of the total amount of various cross-chain Bitcoin assets. At present, the TVL of Bitcoin assets on the Ethereum chain accounts for 16% of the total TVL of the DeFi market. Compared with Bitcoin's core position in the entire industry, the current TVL value is seriously low, and there is still a lot of room for increase.

From the perspective of asset size or capital pursuit of profit, DeFi is bound to have a place in Bitcoin in the future. This article analyzes the pioneering project in this field-Badger DAO, to further introduce how Bitcoin gains benefits in DeFi.

II. Basic information of Badger Dao

Badger Dao was officially launched on December 4th of this year. The project has been in operation for less than a month, but the TVL has quickly surpassed $400 million and ranked 13th in the DeFi ranking.

Figure 4 Badger Dao lock volume, data source: DeBank

According to its official website, the project consists of the following three main segments.

DAO - Decentralized Autonomous Community

Sett - Revenue Aggregator

DIGG - elastic supply asset linked to the bitcoin price (coming soon)

As a public community platform, DAO is the cornerstone of the long-term development of the entire project. Its purpose is to continuously develop more Bitcoin-related DeFi products. In order to allow community members to have a common ownership and a sense of identity, the community motivates members for a long time through Token rewards and other methods. Users can also vote on proposals by holding Tokens, thereby realizing the governance of the project by Token holders. Another more important purpose of DAO is to reward members who have contributed to the community, such as those who develop new products or optimize existing products and strategies, and promote project innovation through Token rewards. The specific use of Token can be determined by community discussion and voting.

Sett, as a revenue aggregator, maximizes the asset revenue by implementing different revenue strategies. Currently, Badger Dao has two types of Setts systems, namely Native Setts and Super Setts. Among them, Native Setts has 5 core machine gun pools, including Badger/WBTCUniswap LP, Badger Pool, sBTC Curve Pool LP, renBTC Curve Pool LP and tBTC Curve Pool LP. Super Setts is a strategy pool for partners, and currently there is only one harvest finance/renBTCLP.

DIGG is an elastic supply asset linked to Bitcoin to be issued by Badger Dao. The smart contract will adjust the supply every 24 hours to ensure that the DIGG price is anchored to the Bitcoin price. DIGG is based on the same mechanism as Ampleforth. Since DIGG's supply adjustment occurs at a fixed time every day, there must be short-term arbitrage opportunities to earn from the difference between DIGG and Bitcoin.

III. The prospect of Bitcoin in the DeFi field

Faced with the low standard income of CeFi currency, BTC holders have a strong desire for cross-chain profit-seeking. It can be said that all BTC holders have DeFi needs. The project represented by Badger Dao has promoted the pace of BTC's entry into the Ethereum ecosystem and the DeFi world. The encounter of BTC and DeFi may become a singular moment in the digital asset market. When the assets with the highest market value and the largest consensus are integrated with the most active and innovative ecology, this field is full of imagination. In the past ten years, BTC has achieved a qualitative leap and won the recognition of traditional capital; and in the next ten years, decentralized finance is expected to further promote the innovation and exponential development of the industry.