Time has value, and interest rates are the most fundamental expression of the value of time. By exploring and studying interest rates, we can gain a deeper understanding of the nature of finance and use it to develop trading models that are widely applicable to various scenarios and capture long-term stable business value.

1. The Origin of Interest Rates

Interest rates are one of the most important variables in today's economic models. Almost all financial assets and financial phenomena are linked to interest rates in one way or another. Interest rate policy has become the main instrument of central banks to regulate money supply and demand and economic growth. However, it arises for no more than five main reasons:

- Delayed consumption: When a lender lends money, it delays its consumption. According to the Time Preference principle, consumers prefer to obtain current goods over future goods, thus generating interest rates.

- Expected Inflation: Most economies experience inflation. This means that the same amount of money will buy fewer goods in the future than at the present, so the borrower needs to compensate the lender for that loss.

- Opportunity cost: The lender is giving up the possible return on other investments by lending the money, so the borrower has to compete with other investments for the money.

- Investment risk: The borrower is at risk of not being able to repay and the lender is required to charge an additional fee to compensate for the risk it has taken.

- Liquidity preference: People tend to prefer a state where funds or resources are readily available for withdrawal rather than requiring time to retrieve them, so they need to be compensated for the liquidity they sacrifice.

In principle, lenders need to compensate borrowers for the above five preferences or risks. Of these, delayed consumption, opportunity cost, and liquidity preferences constitute the prime rate, while expected inflation is related to the nominal rate only, thus leaving only investment risk to directly affect the real rate. By logic, the real interest rate is essentially positively correlated with investment risk.

2. Pricing of interest rates

Since the birth of economics, the interest rate determination system has undergone the development and evolution of many different theories. The main ones include the classical interest rate theory, Keynesian interest rate theory, the loanable funds interest rate theory, and the IS-LM interest rate analysis model. The classical interest rate model is too primitive, while the loanable funds interest rate theory and the IS-LM interest rate analysis model involve macroeconomic data and are beyond the scope of this paper. In order to facilitate understanding, this paper takes the clearest and intuitive Keynesian interest rate theory as an example.

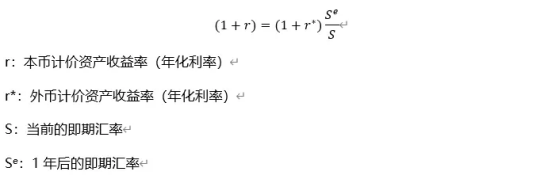

Keynesian interest rate theory is also known as Interest Rate Parity Theory (IRPT). The core idea of this theory is that the spread between spot and forward exchange rates of different currencies is determined by the interest rate differential between the two currencies. This is reflected in the fact that a high-interest-rate currency must be discounted in the forward market and a low-interest-rate currency must be appreciated in the forward market. Taking the Uncovered Interest Rate Parity(UIRP) model that does not involve Interest Rate futures as an example, the definition is that under the condition of sufficient international liquidity of capital, investors' arbitrage makes the returns of similar assets denominated in different currencies in the international financial market converge. In other words, the cross-country liquidity of arbitrage capital ensures that the "Law of one price" applies to international financial markets, as follows:

: Return on Local currency denominated Assets (annualized interest rate)

: Return on Local currency denominated Assets (annualized interest rate)

: Return on foreign currency denominated Assets (annualized interest rate)

: Return on foreign currency denominated Assets (annualized interest rate)

: Current spot exchange rate

: Current spot exchange rate

: Spot exchange rate after one year

: Spot exchange rate after one year

Simply put, the faster a currency depreciates, the higher the interest rate, thus compensating for its loss of value. Theoretically, when parity fails, international lenders will earn profits through arbitrage and return the parity formula accordingly, thus maintaining the long-term stability of the interest rate parity model.

3. Arbitrage Trading

From a mathematical point of view, the interest rate parity model is beautiful and logically sound. However, the reality is harsh and in most cases, the interest rate parity model does not work for the following reasons:

- Transaction costs: Arbitrageurs need to bear the costs of fees, bid-ask spreads, trading slippage, etc.

- Market barriers: Especially in emerging markets, the international flow of funds is restricted due to foreign exchange controls and other reasons.

- Opportunity cost: The use of arbitrage funds needs to cover the opportunity cost, and other investment methods with higher returns will continue to attract capital outflow.

In summary, for various reasons international lenders have difficulty capturing the theoretical arbitrage opportunities arising from deviations from the parity formula, resulting in a long-term deviation from the parity formula, which in turn has given rise to a new trading model that we generally call Carry Trade. The core concept is to earn interest rate spreads by shorting low interest rate currencies and going long on high interest rate currencies.

This trading model carries a huge volume and is widely used in various large hedge funds. According to estimates from the School of Economics of Nanjing University, the overall size of global hedging transactions reached $500 billion in 2002. Since then, due to the rise of interest rates in many countries, the size of hedging transactions rose rapidly, reaching a peak of $1359 billion in 2007, and only cooled down due to the financial crisis, but the size remained above $800 billion before 2011.

4. U.S. Dollar Interest Rates

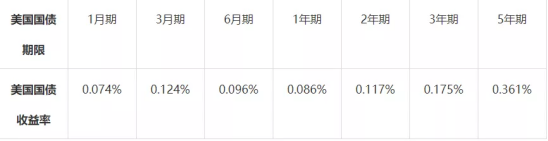

As the Covid-19 pandemic that swept the world earlier this year dealt a major blow to the global economy, major global central banks, led by the Federal Reserve, implemented an unprecedented policy of heavy lending to stimulate the economy, and dollar interest rates plunged in response, with U.S. Treasury yields converging to 0%.

Against this backdrop, global capital was desperate to find an asset side that could offer higher yields. This has led to a significant appreciation in global asset markets on the one hand, and on the other hand has led to significant opportunities in the high interest rate zone, including the crypto world.

5. The Crypto World

If we think of interest rates as the law of time in the financial world, the nascent crypto world's laws of time are still in a chaotic state. This chaos is not only reflected in the huge interest rate differential between the traditional financial world and the crypto world, but also in the spreads and risk inversions that are prevalent within the crypto world.

Unlike the traditional world where there is a globally accepted interest rate indicator such as LIBOR, the crypto world has a more fragmented and chaotic interest rate. And due to the difference in business models, interest rates in the crypto world are more unique. Let's briefly explain some of the most important interest rate data.

6. Deposit and Lending Rates

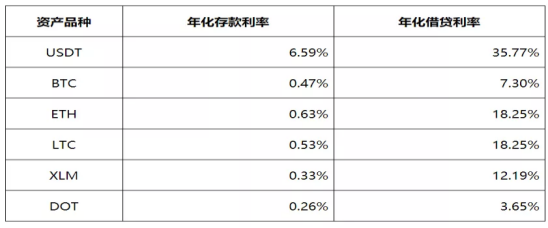

Readers are certainly familiar with deposit and lending rates, but perhaps not sensitive to them. Let's start with a brief list of deposit and lending rates for a particular trading platform as follows:

As you can see, the difference between the deposit and lending rates of different assets on this platform is huge. The lending rate of USDT is almost 10 times that of DOT, and the deposit rate is more than 20 times that of DOT. This is a visual representation of the time value of different assets. Therefore, readers must understand that simply holding assets will keep losing time value, and the time value of different assets varies greatly, which may cause incalculable hidden losses.

In addition, interest rates in the crypto world are much higher than in the traditional world. By analogy with the US dollar interest rate, the current LIBOR has been as low as 0.08288%, while the deposit rate of USDT in the above-mentioned platform is still as high as 6.59%. This reflects the systemic risk of the crypto world itself on the one hand, and also stems from the special business model of the crypto world on the other.

In the traditional world, lenders do not have access to the use of lending collateral without incurring a counterparty credit default. Due to the unique properties of crypto assets, crypto asset lending usually requires the borrower to transfer the right to use the collateral assets to the lender. According to industry practice, the lender has the right to use some or all of the collateral assets for revenue enhancement. This results in the lender being able to bear a higher lending rate, which actually corresponds to a higher risk of default.

7. Perpetual Funding Rates

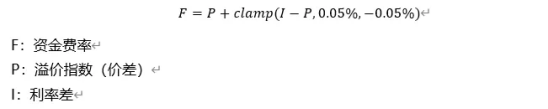

The perpetual contract is one of the most successful financial products to cross over from the traditional world to the crypto world, and Bitmex has established itself as an industry giant with this product. The perpetual contract is never delivered and relies entirely on a periodic funding rate to anchor the spot price. The funding rate and the interest rate are directly linked by the following formula:

F: Funds rate

P: Premium index (spread)

I: Interest rate spread

In simple terms, there are two parameters in the calculation of the funding rate for perpetual contracts: the spread, or premium index, and the interest rate. The spread is formed by the market dynamics, while the interest rate is predetermined by the trading platform. Therefore, the funding rate of a perpetual contract is a representation of the deviation between the market rate and the trading platform's preset rate.

8. Spot spreads

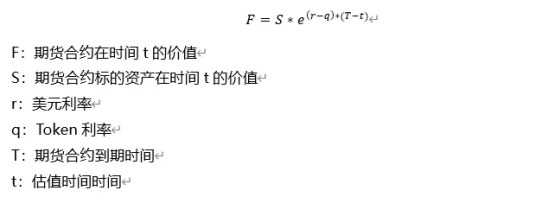

Delivery contracts are the largest financial derivatives in the crypto world in terms of trading volume and positions. The futures spread (the difference between the futures contract and the spot price of the underlying asset) is another form of interest rate expression. The option pricing model is shown below:

F: The value of the futures contract at time t

S: The value of the underlying asset of the futures contract at time t

r: US Dollar Interest Rates

q: Token Interest Rate

T: Futures contract time to maturity

t: Valuation time

In simple terms, the relationship between the futures price and the spot price depends on 2 parameters, the interest rate differential and the time to maturity. For each calculation, the time to maturity is fixed. Therefore, the futures spread can be considered as a realization of the interest rate differential.

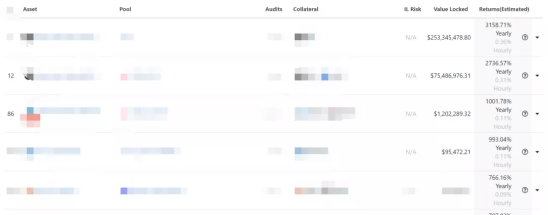

9. DeFi Yield Farming

The concept of decentralized finance (DeFi) has been sweeping the crypto world this year. I believe readers have more or less participated in or heard about the miracle of DeFi yield farming, which has a wide range of products. The staking model, risk model and return model all vary, which brings more and more complex interest rate models. Since it is not the focus of this article, only some of the DeFi yield farming products are shown here with the following yields:

Data source: CoinGecko

As you can see from the table above, the yields on DeFi products seem unconscionably high, just as the price of the bitcoin was unusually cheap in the early days. If we stand back years later, such high yields do not only correspond to high risk, but also stem from the industry's early dividends.

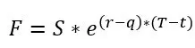

10.The use of Carry Trade in the crypto world

Carry Trade can be profitable not only by linking the traditional world with the crypto world, but also by profiting from the spreads within the crypto world. The reader can combine the various forms of interest expressions listed in this paper. In this article, we will briefly explain the principle of futures arbitrage as the simplest example. First of all, let's go back to the following futures pricing formula.

Obviously, when the left term of the equation is greater than the right term, the futures price is overvalued and we can make a profit by holding the spot while shorting the corresponding futures. When the left term of the equation is smaller than the right term, the futures are undervalued and we can make a profit by going long on the futures and leveraging to go short on the spot.

11. The Meaning of the Game of Interest Rate

Carry Trade is one of the common trading models in the traditional financial world, and this model is especially effective in the crypto world, which is in a chaotic state. We believe that this industry dividend will not disappear in the near future, but we also realize that it will eventually disappear. With this sense of urgency, we are able to efficiently explore more effective trading opportunities.

Carry Trade is also very important for the sustainable development of the market. On the one hand, Carry Trade provides investors with hedging opportunities, helping to bring distorted market prices back to normal levels; on the other hand, the huge arbitrage space will drive a continuous influx of capital, raising asset prices while providing ample liquidity to the market.