I. The booming options market

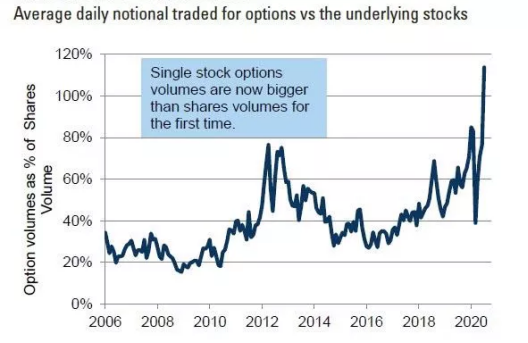

In the wake of the COVID-19 pandemic, global markets tumbled into a crisis fermented over a decade of monetary easing. Surrounded by elevated volatility, acute shift of risk appetite, and easy-to-access trading venues supported by technology, a wide range of market participants stepped into the more sophisticated option market and drove the volume to a level not seen in the history. (1) For the first time, the single stock option trading volume has surpassed that of shares

Per a report published by Goldman Sachs, the trading volume in the US single stock options has increased by 129% year-to-date in 2020 driven by the influx of retail investors, including a record 35% increase in July alone, marking the option trading volume over shares exceeded 100% for the first time.

Source:Goldman Sachs Global Investment Research, Option Metrics, Data as of 21-July

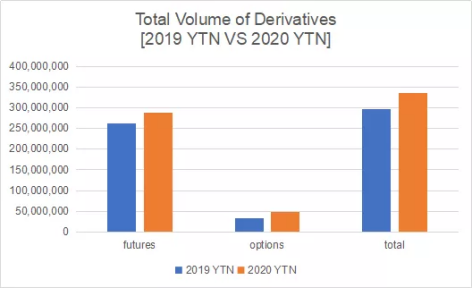

(2) Options trading led the derivatives market over the same period

Supported by ICE data over 2020 Jan. to Nov. the option trading volume (as contracts settled) had grown 42.24% year-on-year, reached 3,350,772 contracts and dwarfed the 10% growth of future contracts.

This future evidences the growing popularity of option contracts among market participants.

Source: ICE, measured in Million of USD

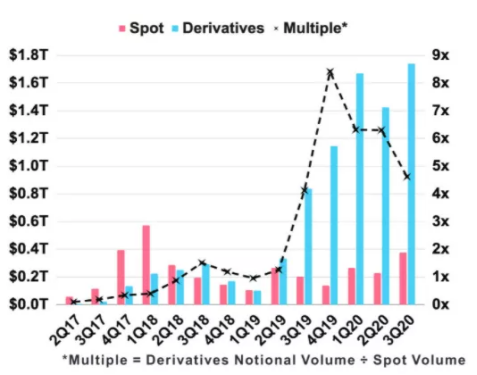

(3) Rapid development of the options market for digital assets

The development of the options market is one of the signs that traditional finance is maturing. In the digital asset industry, where the rate of innovation and development is growing exponentially, options and the structured products constructed from them are also gradually taking over the market.

As the use of sophisticated derivatives reflects the maturity of an asset class, digital asset market has been witnessed the development of options and structured products.

Derivatives have stepped over spot trading and become the dominant venues of the digital asset trading. The notional value of derivatives traded has surged from US$60 billion in Q2 2017 to over US$1.7 trillion in Q3 2020 [per Kraken].

Source: Kraken,Crypto spot volume VS Crypto derivatives volume

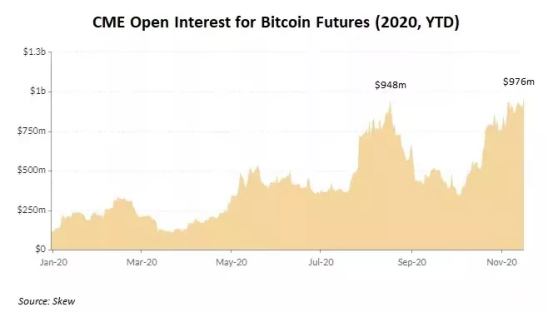

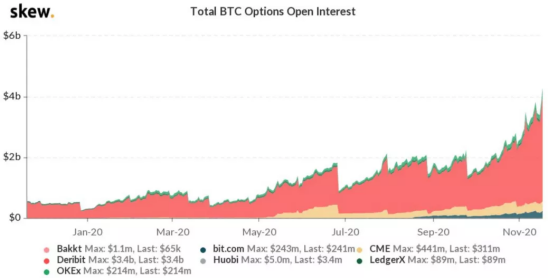

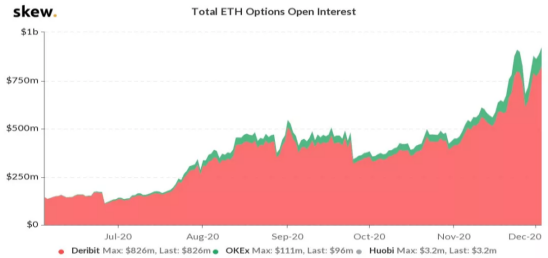

Open interest of cryptocurrency futures and options has risen significantly since the beginning of 2020 with the growth of option exhibiting particular steepness.

Source: Skew

Per CME and Skew, open interests of the BTC options market currently stands close to $4.7 billion as of 10 December 2020; while that of ETH options market reaching US$850 million.

II. The value of options

From the first standardized option contract floating in Chicago Board Options Exchange (CBOE) on April 26, 1973 to the 2020-explosion of option trading in both traditional asset class and cryptocurrency the option market has withstood the testing of time, and exhibited strong upward trend

Options have three more important values:

- Options are effective tools for hedging

- Options require significantly lower upfront capital than exposing the same exposure via spot

- Options are basic blocks for constructing non-linear risk profile

Making using of options, investors can express sophisticated market views that otherwise not possible via linear products.

On the other hand, the options process disadvantages including low liquidity, requiring sophisticated pricing model to gauge risk, and less transparent time value.

As an (call) option seller, the maximum profit is capped at the upfront premium (typically 5%-20% of the value of the underlying stock); while the seller is exposed heavily to the tail risk. In the scenario where the price of the underlier rises to a level significantly above the strike price, the option seller's loss may be several or even tens of times the option premium. As the seller of an option is in a position to take unlimited risks over a long period of time, most sellers of options are professional investment institutions with a high risk tolerance, such as investment banks, funds or insurance companies. After establishing an option seller position, the option seller can also hedge out some of the risks through stop-loss trading strategies, delta hedging and other strategies.

III. Structured income products constructed with options

The payoff profile of options make them ideal for structuring various financial products, for example, Dual Currency Deposit.

Dual Currency Deposit (DCD) products are linked to currency exchange rates and arbitrage the exchange rate differential between two currencies through different portfolios based on the investor's expectations of the exchange rate. Investors can invest or deposit in one currency, A, and withdraw in a different currency, B, at the maturity of the contract. As the exchange rates among currencies be volatile, dual currency banking carries additional FX risk, compensated by higher expected returns.

Dual currency banking products have long been established in the traditional financial sector, particularly in Asian banks. In Japan, dual currency deposits have been popular since the 1990s. In China, the first product of this kind was launched by China Merchants Bank and Everbright Bank in 2005.

At present, dual currency deposits in China are structured according to the following models:

l Everbright Bank model: RMB principle with interests settled in ?

l China Merchants Bank model: allow both RMB and USD principle with interests settled in USD.

l HSBC model: deposit paying interests according to a given FX cross rate. Essentially, it is a deposit with embedded FX cross rate option.

Generally speaking the yield of such a portfolio is higher than that of a typical wealth management product, but there are some risks involved, the main one being the exchange rate of the RMB against foreign currencies such as the USD or EUR. HSBC's structured model, differing from the other two, will be the focus of this paper.

The existing crypto currency wealth management product is a floating income non-principal protected investment product, featuring 'one investment, two returns' with a distinct model.

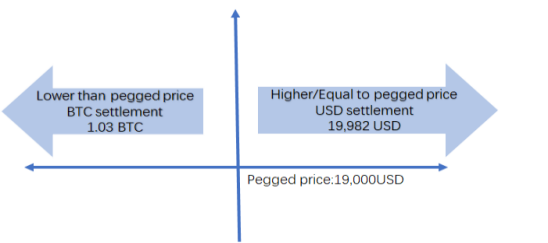

Taking the BTC denomination as an example

An investor purchases a 'BTC-USD Dual Currency Money' product with a maturity of 11 days on 1 December, assuming that BTC is quoted at $19,200 on spot and

Pegged price: $19,400

Expiry date: 12 December

Investment amount: 1 BTC

Yield: 3%

At the expiry date, 12 December, there will be two possible outcomes.

If the settlement price of BTC is lower than the pegged price of $19,400, it will be settled in BTC and the settlement amount = (1 + yield) * number of purchases = (1 + 3%) * 1 = 1.03 BTC.

If the settlement price of BTC is higher than or equal to the peg price of $19,400, the settlement will be made in USD and the settlement amount = (1+yield)*peg price = (1+3%)*19,400 = 19,982 USD.

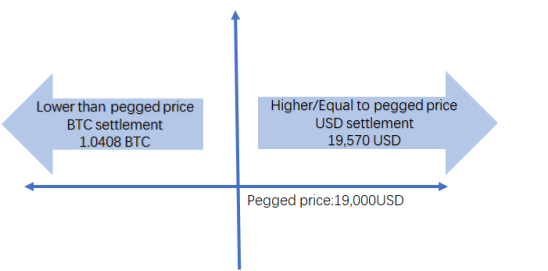

Taking the USD denomination as an example

An investor purchases an 11-day 'USD-BTC Dual Currency Money' product on 1 December, assuming that BTC is quoted at $19,200 on spot and

Pegged price: $19,000

Expiry date: 12 December

Investment amount: US$19,200

Yield: 3%

At the maturity date of 12 December, there will also be two possible outcomes.

If the settlement price of USD-BTC is less than or equal to the peg price of $19,000, the investor will be settled in BTC with the settlement amount = Quantity purchased / peg price * (1 + 3%) = 19,200 / 19,000 * (1 + 3%) = 1.0408 BTC.

If the settlement price of USD-BTC is higher than the peg price of $19,000, the investor will settle in USD and the settlement amount = (1+yield)*peg price = (1+3%)*19,000= 19,570 USD.

In the case of a crypto-based purchase, if the settlement price is higher or equal to the peg price, the investor can cash out at a higher level; if the settlement price is lower than the peg price, the investor can receive more BTC.

For fiat-based purchases, if the settlement price is higher than the pegged price, the investor will receive more USD; if the settlement price is lower than or equal to the pegged price, the investor will be able to take a relatively low price on BTC.

In summary, although the BTC-USD settlement price will vary at the maturity date, the investor will always receive a definite return of 3%, the only uncertainty being the type of funds returned settled in (BTC or USD).

IV. Investor Preference

For investors who is uncertain on whether holding BTC or USD, the optionality itself might be a liability. At this point, they can sell their optionality to the market and thus receive some premium. Due to the high volatility of digital assets, this compensation is often higher than traditional returns.

For example, miners, a group that prefers to hold BTC and has a need to realize it, but is also actively optimistic about BTC's growth potential, can sell BTC at a higher price through dual-currency finance; and if the price of BTC falls back during the investment period, miners are willing to exchange it for more coin-based gains.

Another group, investors who want to gain relatively stable income in the BTC market, less appetite on market volatility and are willing to hold BTC at low levels, can use Dual Currency Banking to gain dollar gains when the price of the currency is high and build up BTC inventory when the price is low.

This product, with dual currency involved, offers more kinds of risk-return profile to different types of investors.

V. The potential of structured products for digital assets

Within the traditional asset world, structured products trading is the area under most rapidly development in recent years. Equipped with high customization potential, structure products can be tailored efficiently to satisfy various risk appetites, making them particular popular among investors and standing as a powerful tool for asset management.

Structured products have enriched the risk profile available in the digital asset market and met the demands of a wider range of capital. The dual currency option described in this article is only one of the simpler types of structured products.

The digital asset market has long been criticized by traditional capital for its single source of return and its highly volatile nature. Structured products have the potential to successfully address the concern, and bring in capital of different risk appetites to the market.

In 2020, we witnessed a boom in financial instruments such as futures and options in the digital asset industry; exponential growth in the size of DeFi and CeFi; and a further increase in demand for structured products. These financial innovations, which have accelerated the development of a multi-layered capital market in the digital asset area, signals of the increasing sophistication of the industry. In the future, the digital asset market will be more richly organized and attract more diverse types of capital.