A Social Experiment Stemming from the Financial Crisis

Looking back to 2008, when the capital market was caught in an unprecedented crisis, the financial crisis broke out in the United States and spread to the world after the collapse of Lehman Brothers. In response to the financial crisis, the Federal Reserve began to cut interest rates. On December 16, 2008, the Fed announced that it would lower the federal funds rate to an ultra-low level of 0% to 0.25%, officially entering the era of zero interest rate, which can be clearly seen in Figure 1 below.

Since there was no longer room for interest rate cuts, the Fed then adopted unconventional monetary policy tools such as large-scale purchases of U.S. Treasuries and mortgage-backed securities to depress long-term interest rates, stimulate the economy and inject liquidity into the market, opening an unprecedented quantitative easing policy. From the end of 2008 to October 2014, the Federal Reserve has introduced three rounds of quantitative easing, purchasing assets totaling about $3.9 trillion. The size of the Fed's asset holdings as a percentage of GDP rose sharply from about 6.1% at the end of 2007 to 25.3% at the end of 2014, expanding its balance sheet to unprecedented levels.

Figure 1 Change in the benchmark federal funds rate over the last 20 years in %

After reflecting on such periodic economic crises in human history, on November 1, 2008, a mysterious cryptography geek going by the pseudonym Satoshi Nakamoto posted the Bitcoin Whitepaper "Bitcoin: A Peer-to-Peer Electronic Cash System" on a secretive cryptography commentary group. This was a new vision of electronic money, and the concept of Bitcoin was introduced. Two months later, in January 2009, Satoshi Nakamoto created the Bitcoin creation block by hand on a small server in Helsinki, Finland, and was rewarded with the first 50 Bitcoins. Thus, Bitcoin was officially born.

The Revenue Champions Created in the Era of Great Discharge

In 2020, the once-in-a-century COVID-19 Pandemic hit the global economy especially hard. At one point, national lookdown measures brought economies to a massive halt, unemployment rates soared, and second-quarter GDP fell at a generally record extreme rate. The International Monetary Fund's Global Economic Outlook, released in October, predicted that the global economy will shrink by 4.4% in 2020, equivalent to seven times the decline in 2009, the worst recession since the Great Depression in the 1930s. The World Bank likewise expected the global GDP to grow negatively by about 5.2% in 2020. More than 170 of the 189 countries will experience negative growth, a recession roughly more than twice the size of the 2008 subprime mortgage crisis.

Looking back to March 2020, the U.S. stock market had four trading curbs in eight consecutive trading days, an unprecedented situation; the Dow Jones Industrial Average fell 13.7%, Brent crude oil futures prices fell 55.0%, and the yield on the U.S. 10-year Treasury note fell from 1.13% to 0.70%. In response to the crisis brought about by the COVID-19 virus, central banks, represented by the Federal Reserve, implemented an unprecedented ultra-easy monetary policy to inject liquidity into the market. In March this year, the Federal Reserve cut interest rates twice in 12 days for a total of 150 benchmark points, lowering the benchmark interest rate to 0-0.25%. And the Fed announced the start of uncapped quantitative easing at the same time after the rate cut, issuing an additional $4 trillion in the following few months, with balance sheet expansion accounting for two-thirds of the total expansion of global central banks. According to statistics, 22% of all dollars ever printed were printed in the year 2020. As can be seen in Figure 2 below, the Fed's base money placement increased rapidly in 2020.

Figure 2 Fed base currency changes in millions of dollars

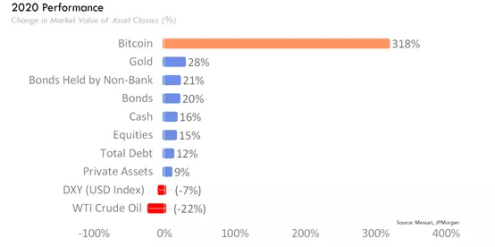

The times produce their heroes. The era of the Great Discharge created a champion of returns in Bitcoin. In 2020, Bitcoin rose 318% for the year, significantly outperforming all major asset classes in terms of returns.

Figure 3 Broad asset class returns in 2020 Data source: Messari, JP Morgan

The Era of Institutional Investment in Bitcoin

In 2020 many countries adopted a major economic stimulus in the form of deflation, and Bitcoin, which has anti-inflationary properties and is extremely scarce, seen as an investment option to hedge against the declining of US dollars and long-term inflation risks. Institutions began to flock to the bitcoin market in a frenzy, and many of them are also listed companies, with companies such as MicroStrategy and Square buying large amounts of bitcoin directly; in October 2020, payment giant Paypal supported customers to buy, hold and sell digital assets such as BTC and ETH directly in the Paypal and Venmo apps, opening up a wider retail channel for the industry, and bitcoin soared in response. PayPal CEO Dan Schulman has said in an interview that the digital asset use cases will grow, which will allow Bitcoin to gain a broader consensus.

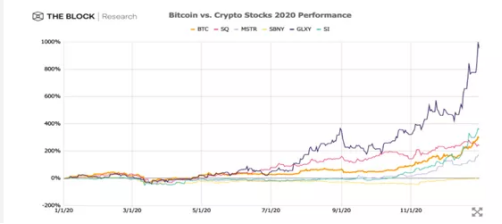

Michael Saylor, founder and CEO of MicroStrategy, said he has purchased 88,000 bitcoins through MicroStrategy and the entities he controls. At the current price of about $33,000, its bitcoin holdings are worth more than $2.9 billion. According to The Block Research, the 2020 bitcoin bull run has resulted in a bumper haul for stocks of publicly traded companies related to digital assets. Among them, Galaxy Digital is up 952%, Microstrategy is up 166% and Square is up 239%. It is evident that public companies buying bitcoin can not only gain from the appreciation of bitcoin, but also improve their stock performance, and it is believed that more public companies will enter the digital asset market in the future.

Figure 4 Bitcoin and Related Company Stock Price Gains in 2020

The Revolt Against Traditional Finance

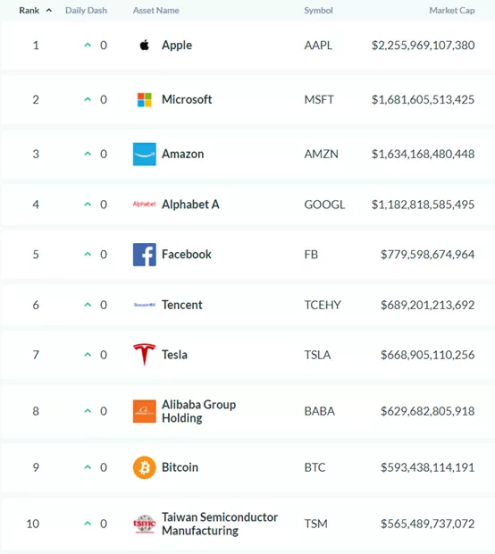

Bitcoin's market capitalization reached $612 billion according to real-time data on Jan. 4, placing it on the top 10 list of publicly traded companies in terms of market capitalization. On Dec. 26, Bitcoin's price rose to $25,000, surpassing the market capitalization of Visa, which provides a global network of credit card clearing services. On Dec. 31, Bitcoin's price surpassed $29,200, surpassing the market capitalization of Warren Buffett's Berkshire Hathaway Inc. Traditional financial views on Bitcoin have also shifted with its performance, with JPMorgan Chase previously releasing a report that saw significant upside ahead for bitcoin. Visa is also actively partnering with cryptocurrency companies globally, and it is believed that more traditional financial capital will be involved in the future.

Figure 5 Bitcoin market capitalization vs. market capitalization of publicly traded companies Data source: AssetDash

Digital Gold

Money is not naturally gold, but gold is naturally money. Since 560 AD until the end of the Bretton Woods system in 1971, gold was used as a single or one of the currencies by various countries around the globe. Gold is the early discovery of mankind and used as assets by mankind, because gold is rare, special and precious. So gold has the title "king of metal", and enjoys a high reputation that other metals cannot compare to. With the development of society, the economic status and application of gold are constantly changing, but it still occupies a place in the international reserve of various countries. It is a special commodity with attributes of currency properties, commodity properties and financial properties. According to the December 2020 International Financial Statistics, gold has a high share of foreign exchange reserves in the United States, Germany, Italy and France. As Bitcoin's scarcity surpasses that of gold, central banks may include Bitcoin as a reserve asset in the future.

Figure 6 Official Gold Reserves of Major Countries/Institutions Data Source: World Gold Council

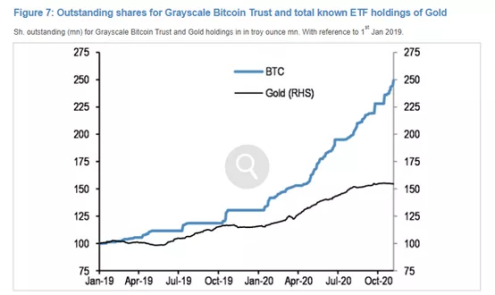

Ray Dalio, co-chairman of the Bridgewater fund, has said in an interview that Bitcoin and some other digital assets have established themselves as alternatives to gold assets over the past decade; JPMorgan Chase noted in a report that Bitcoin is eating into demand for gold ETFs. The market has also seen more demand for Grayscale's Bitcoin Trust than for all gold ETFs combined since 2019.

Figure 7 Grayscale Bitcoin Trust vs. Known Gold ETF Demand Data Source: Bloomberg, JP Morgan

Bitcoin Future Price Outlook

A Monetary Asset Perspective

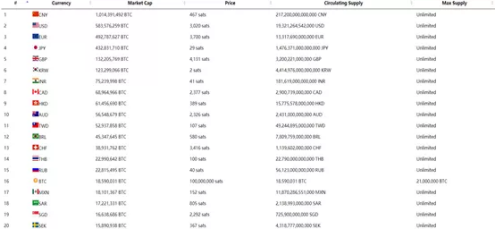

Looking at the comparison between the market value of money supply in circulation in major countries around the world and the market value of Bitcoin, the current market value of Bitcoin sits at the 16th percentile; central banks' money supply adjusts according to economic development and the maximum supply is unpredictable, while the maximum supply of Bitcoin is only 21 million. Based on the static data measured on January 4, if Bitcoin reaches $41,000, it could surpass the current Russian ruble’s and Thai baht’s market caps; if Bitcoin reaches $100,000, it would surpass the Australian dollar currency’s market cap.

Figure 8 Bitcoin vs. size of currency issuance by country Data source: FiatMarketCap

Equity Asset Perspective

Compared to the current top-ranking large companies in terms of market capitalization, Bit could surpass Tesla's market cap if it rises to $36,000, and surpass Apple's current market cap if Bitcoin rises to $121,500. We believe that as an emerging asset class, Bitcoin has greater value than traditional equity assets. In addition, blockchain is guiding the technological direction for the Internet to evolve from an Internet of technology to an Internet of value. And digital assets such as Bitcoin and Ethereum will become the biggest value carriers in the Web 3.0 era. If we take the current market value of IT giant FAANG as a reference, the price of Bitcoin may be able to exceed $290,000 in the future.

Digital Gold in Perspective

Gold, as a means of storing value, is often not a very good medium of circulation. Likewise, currencies that are better as a means of circulation, such as fiat currencies used around the world, are not as reliable as a means of storing value. Bitcoin, on the other hand, has both storage value and circulation properties. Currently, the Bitcoin market has an average single-day volume of nearly $100 billion, an increase of about 560% year-over-year. With the institutionalization of the market and the construction of a multi-level capital market (spot, futures, options and other derivatives trading markets), bitcoin's liquidity will gradually be on par with the gold market. Currently, the market cap of physical gold is about $9 trillion. If Bitcoin's market cap reaches that level, its price will top $420,000.

During the financial crisis of 2008, the only asset people could choose to hedge against inflation was gold. And now, Bitcoin, birthed out of the economic crisis, is a better option, especially after a halving this year, when its scarcity is once again known to the world. Bitcoin has gained a growing consensus on Wall Street as an emerging asset class. Coupled with the fact that the current demand and supply relationship for the bitcoin has changed significantly, bitcoin's long-term appreciation potential is expected to be recognized by more mainstream institutions and investors.