Bridgewater is the world's largest hedge fund. In his article "Paradigm Shifts," Bridgewater founder Ray Dalio says, "So, the big question worth pondering at this time is which investments will perform well in a reflationary environment accompanied by large liabilities coming due and with significant internal conflict between capitalists and socialists, as well as external conflicts. It is also a good time to ask what will be the next-best currency or sources of wealth to have when most reserve currency central bankers want to devalue their currencies in a fiat currency system." [1] And Bitcoin seems to be a powerful answer to this question from Dario.

Bitcoin is the Best Performing Asset for 2019-2020 Returns

Over the past two years, Bitcoin, as a new asset class, has attracted intense attention from many traditional institutional investors. There are three main reasons for this: First, the Bitcoin trading market continues to expand in size, with the current average single-day volume remaining at $80 billion, providing the necessary market base for a larger volume of capital to participate in Bitcoin investment. Second, Bitcoin lacks an obvious correlation with the volatility of various traditional assets, which meets the asset allocation requirements of macro funds. Third, Bitcoin's return performance in the past has been excellent.

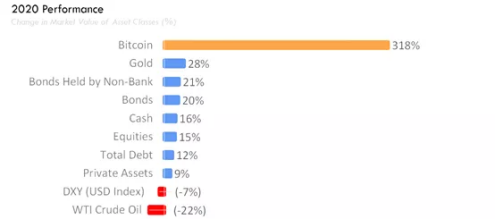

Figure 1: Broad macro asset class return performance in 2020, data source: JP Morgan, Messari [2]

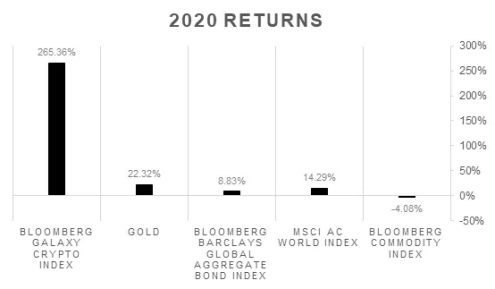

Also according to IDEG, the Bloomberg Galaxy Digital Asset Index rose about 265.36% in 2020, significantly outperforming gold, while also far outperforming the returns of stocks, bonds, and commodities.

Figure 2: Bloomberg Major Financial Indices 2020 Performance Comparison, data source: Bloomberg, IDEG

Trusts Have Become the Largest Compliance Channel for Bitcoin Investment

Despite the outstanding performance of Bitcoin returns, there are many factors that affect how to safely and compliantly invest in Bitcoin. In order to meet the compliance and security requirements of traditional institutions for Bitcoin investments, trusts, as a traditional investment vehicle, have become the best channel for the Bitcoin investment market today, gaining more and more popularity among traditional investors.

Grayscale Investment LLC is the initiator of GBTC, currently the largest bitcoin trust in the world. The trust is a passively managed Bitcoin index-tracking fund. GBTC is open to private placements from time to time of qualified investors and institutional clients, allowing them to subscribe to shares of the trust in either cash or bitcoin. Grayscale's management fee is 2% per year, with a minimum single subscription of $50,000. According to data disclosed by Grayscale, 80% of the clients are institutional investors, 16% are family offices and high net worth individuals, and another 2% are pension funds. The most prominent method for European and American investment institutions to enter the bitcoin market is currently through the GBTC Trust.

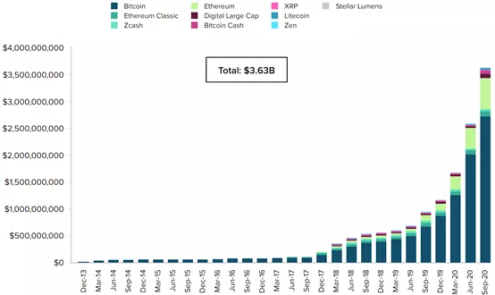

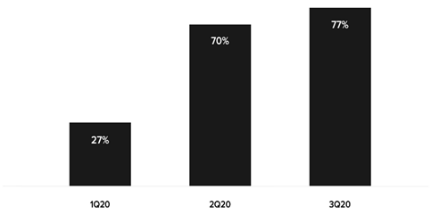

According to Grayscale 2020's third quarterly report, more than $2.4 billion was raised in the first three quarters. Among them, the single-quarter fund inflows from Q1 to Q3 reached $504 million, $906 million, and $1.050 billion, respectively. The fundraising scale of the three quarters consecutively set new historical records, which indicates that the enthusiasm for investing in digital assets continues to climb against the background of global economic uncertainty. At this point, the cumulative investment size of various digital asset trusts offered by Grayscale has reached $3.6 billion.

Figure 3: Cumulative Inflows to Grayscale's Various Digital Asset Trusts, Data as of September 30, 2020 [3]

After the halving of the Bitcoin block reward in May of this year, GBTC inflows at one point exceeded the value of Bitcoin mining output over the same period. The inflows into GBTC were so high relative to the amount of new bitcoin produced that the relationship between supply and demand in the bitcoin market changed, a phenomenon that could be a positive sign foreshadowing further bitcoin appreciation in the future.

Figure 4: GBTC Inflows vs. Bitcoin Mining Output over the same period, data as of September 30, 2020 [4]

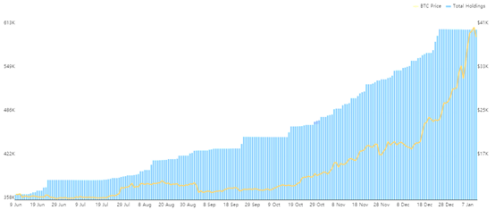

As measured by publicly available data, the GBTC Trust holds a total of 607,037 bitcoins (about 2.89% of total bitcoin) as of December 31, 2020, a 57% increase in size from the end of June. Also according to market data as of Jan. 9, 2021, the trust has reached $24.155 billion.

Figure 5: GBTC Trust Fund Positions, Data as of December 31, 2020 [5]

Why are Bitcoin Trusts Favoured by Traditional Investors?

According to a survey of the U.S. financial advisor industry conducted by Bitwise and ETF Trends, 76% of financial advisors report receiving investment inquiries from clients about digital assets in the past 12 months, and 72% believe their clients are likely to have invested in digital assets. 54% of financial advisors say that digital assets are most attractive to them for allocation because of their overall weak correlation to traditional assets [6]. Since 2019, mainstream media and Wall Street analysts have continued to discuss the "digital gold" properties of Bitcoin. This has resonated with the U.S. financial advisor industry as well.

The survey also revealed the main reasons preventing traditional investors from investing in digital assets, including

- 53% - regulatory reasons

- 41% - Don't know how to value digital assets

- 39% - Lack of easy access to investment tools

- 34% - Concerns about not having safe custody

With the above survey data, we can see that traditional investors are extremely interested in investing in Bitcoin, but suffer from a lack of compliant and secure investment channels. The Bitcoin Trust, as a traditional investment vehicle, is a good solution to many of the concerns of traditional investors:

Trusts solve the compliance problem of bank funding channels. Private channels for buying and selling bitcoin face subjective credit risk; and private channels are small in volume and cannot sink large amounts of capital, so they are not applicable to institutional clients. By subscribing to trust shares, institutional investors can make public-to-public transfers through their trust accounts to legally and compliantly buy and hold bitcoin assets.

Trusts solve the security problem of keeping bitcoins in the custody of clients. Bitcoin is a purely digital form of asset type that faces multiple security risks such as network security, storage device security, and key custody. The total number of bitcoins is 21 million, with approximately 18 million currently in circulation in the market. Of these, the number of confirmed lost bitcoins is close to 1.7 million. At current prices, the value of lost bitcoins is nearly $60 billion. Bitcoin trusts typically work with a custodian to ensure the safety of bitcoin assets in custody.

Trusts address financial audit compliance issues. Trusts are subject to rigorous third-party audits, and Bitcoin trust assets can be credibly consolidated into the financial statements of public companies and large investment institutions, avoiding the problem of unconsolidated statements due to differences in local financial auditing regimes.

It is those advantages that make trusts the most popular and compliant investment channel in the Bitcoin market today. The success of GBTC's operations over the years has fully validated the trust channel's reliability.

Limitations of GBTC and the Growth of Trusts

Although GBTC is currently the most successful Bitcoin trust fund in the market, there are limitations to its terms and conditions. First, GBTC is a passively managed trust, meaning that it is bought and held inactive, with returns entirely tied to the rise and fall of bitcoin itself. Second, GBTC shares are not redeemable, and investors can only choose to sell in the open market after the lock-up period. As a result of this, the premium of GBTC shares over the actual price of bitcoin has been high, peaking at 140% and currently remaining at around 20%. This means that investors must pay a higher cost to buy GBTC shares.

Figure 6: Historical premiums for GBTC shares, data as of January 8, 2021 [7]

Due to GBTC's success, and its apparently flawed terms, there are some strong upstarts in the Bitcoin trust fund field. On June 12, 2020, Wilshire Phoenix FundsLLC filed an S-1 registration affidavit with the SEC for approval of its Bitcoin trust product. The trust employs Fidelity Digital Assets as a custodian to hold Bitcoin assets, and its management fee is 0.9%, well below the 2% of GBTC trusts. But these trusts are primarily geared toward the U.S. market.

And in the Asia-Pacific region, this field is also gaining attention from investors. In November 2019, IDEG spearheaded the launch of Asia's first Bitcoin trust, Asia Digital Trust, in Hong Kong, which includes two sub-trusts, Asia Bitcoin Trust (ABT) and Atlas Mining Trust (AMT). IDEG's core members have been focused on quantitative trading in the digital asset sector since 2013 and are known for their robust strategies. In addition, IDEG's parent company is a leading global professional blockchain investment institution. IDEG's parent company is deeply involved in the key tracks of blockchain infrastructure, underlying public chains and applications, and has invested in many star projects globally, including Canaan Creative and Polkadot, with excellent investment returns. ABT and AMT Trust are managed by Coinbase Custody, the world's largest digital asset custodian, which currently has over $10 billion worth of digital assets in custody and has not had a single security incident since its inception.

ABT is a trust that focuses on bitcoin trading. Unlike GBTC's passive management strategy, ABT employs an active income-enhancing strategy. The advantages of the active strategy are mainly reflected in two aspects: through a low-risk arbitrage strategy, it earns a larger amount of bitcoins to maximize the dividends from bitcoin appreciation; on the other hand, through hedging strategies to effectively control the retreat, it avoids extreme market risks. Therefore a trust with an income-enhancing strategy will have higher returns than a passively managed trust.

AMT, on the other hand, is currently the world's first bitcoin mining trust, providing a compliant channel for traditional investors to participate in bitcoin mining. Bitcoin mining is a capital-intensive industry, and retail or small institutional miners lack the necessary competitiveness in face of large capital. Trust funds can create capital advantages and scale effects, thus providing investors with more reliable mining returns. In addition, there are high industry and operational barriers to bitcoin mining. The trust is able to maintain a competitive advantage in mining machine procurement, power procurement, mine site design, mine operation, daily maintenance and security, and reduce operational costs by leveraging its brand and capital advantages.

By analyzing the bitcoin trust market, we can see that the sector is gradually evolving from a monopoly to a competitive, evolutionary direction. Compared to exchanges and OTC dealers, GBTC has been a great success because of its compliance and security advantages, which quickly attracted many traditional investors in the short term. However, due to its own limitations, it led to inefficient use of capital. Investors have begun to seek better investment vehicles to participate in the Bitcoin market. It is in this market environment that trust fund products have emerged that are more in line with local market demand and better-designed terms, providing traditional investors with a compliant, secure and convenient investment channel.

Reference:

1. Ray Dalio,"Paradigm Shifts", LinkedIn, https://www.linkedin.com/pulse/paradigm-shifts-ray-dalio/

2. Mira Christanto, Twitter, https://twitter.com/asiahodl/status/1344529644721061889

3. "Grayscale Digital Asset Investment Report Q2 2020", page 5, Grayscale, https://grayscale.co/wp-content/uploads/2020/10/Grayscale-Digital-Asset-Investment-Report-Q3-2020.pdf

4. "Grayscale Digital Asset Investment Report Q2 2020", page 7, Grayscale, https://grayscale.co/wp-content/uploads/2020/10/Grayscale-Digital-Asset-Investment-Report-Q3-2020.pdf

5. "Grayscale Investments BTC Holdings", bybt, https://www.bybt.com/Grayscale

6. "The Bitwise/ETF Trends 2020 Benchmark Survey of Financial Advisor Attitudes Toward Cryptoassets", Bitwise, https://static.bitwiseinvestments.com/Research/Bitwise-Research-ETF-Trends-2020.pdf

7. "GBTC Discount or Premium to NAV", Ycharts, https://ycharts.com/companies/GBTC/discount_or_premium_to_nav